Founder: Jessi Shrider and Anthony Pot Devon

Historical past Arrange: March 2021

Place of Headquarters: Nash Will, TN

Variety of workers: 10

Web site: https://amboss.tech/

Authorities or non-public? Non-public

Jesse Shrader believes that this will likely be an necessary yr for the ability community.

With the rise within the value of constructed -in and the lecturers (USDT), the Shrader has stated that an increasing number of companies and firms will start to see electrical energy for funds subsequent yr.

And his firm, Asbus, is able to assist make this imaginative and prescient a actuality.

“We need to enhance BitCoin as a cost system and use electrical energy to take action,” Shrader advised Bitcoin Journal. “We need to make electrical energy excessive efficiency, excessive efficiency system.

A workforce of Shrader and Asbus has been developed by means of a go well with of instruments and providers, they’re able to trip the subsequent wave of institutional client customers on the planet’s largest allow cost community – particularly now U SDT runs on electrical energy.

What does Ambos do

Ambas primarily supplies clever cost infrastructure for digital funds utilizing an influence community.

“We give individuals insights about what we should always do to extend the efficiency of funds on the community,” stated Shareder.

To satisfy it, they provide quite a few services.

Considered one of these is essentially the most notable Asbus house, {an electrical} community exporter that hires machine studying to assist customers get info from any node on the community or join.

Past their analytical software program, Embos additionally supplies its clients instruments instruments and providers to assist their clients enhance liquidity situations.

Such a service is the Magma Market Place, which permits shoppers to purchase and promote liquidity on the ability community. Utilizing magma, customers can present liquidity.

The second is hydro, the extension of the magma. Software program allows customers to automate their liquidity purchases to make sure the success of funds.

(And Embos, AML (Anti -Cash Laundering) additionally affords a compliance suite for enterprise customers.)

Ambos’s analytics software program and instruments are designed for top -volume transactions, which have gotten extra simpler to generate electrical energy.

“We measure the power to pay with the imitation of companies.” We’ll assist companies see how a lot community they will arrive once they attempt to pay, the Shrader defined. “

The state of electrical energy

On the subject of electrical energy progress, there may be hope for the Sherader. With every passing day, customers are counting on the community simply to ship greater than microphils.

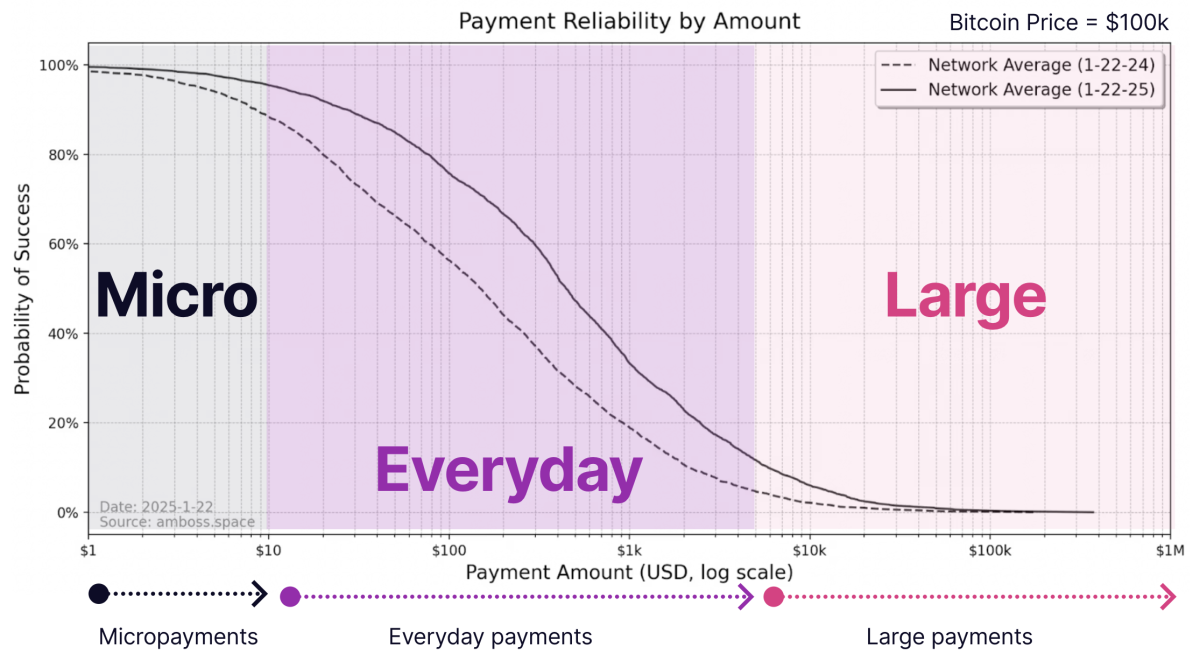

“We’re efficiently appearing on on a regular basis funds about electrical energy, which I’m describing between $ 10 and, 000 4,000 funds,” stated Shrader. “We’re working to additional improve the community capabilities, which is specializing in decentralization.”

Over 4,000 funds are nonetheless troublesome to course of. Shrader defined that processing wants extra funding to assist make massive funds actuality.

Nevertheless, he additionally famous that the latest enhance within the value of bitcoin has helped take main funds extra simply.

“What we now have not too long ago seen is that the value of bitcoin has elevated, which has elevated the power to settle in all electrical energy channels,” stated Sharder. “For the reason that channels are the distinction between Bitcoin, it’s as if we obtained massive pipes.”

And whereas the Sherader is hopeful about these massive pipes, he’s permitting extra thropped, however he additionally believes that the Trainer (USDT) electrical energy is coming to the community much more liquidity. Might be attracted.

Trainer on electrical energy (USDT)

On the finish of final month, the ability labs introduced that it introduced the Bitcoin and the Lighting Community to the USDT by means of the Tiproot Asset Protocol.

This improve allows Bitcoin service suppliers extra simply to attach and settle for USDT, which the Sherder believes it is going to be an honor for electrical energy.

“One of many issues that could be very clear is the product market match,” stated Sharder.

“Final yr, he served $ 10 trillion in funds, which is greater than a visa and a mastercard,” he added.

“It is fairly clear that the world needs US {dollars}.”

Shrader, who’s a practitioner, acknowledged the truth that many hardline bitcoreers have bitcoin and electrical energy -driven points with USDT, and so they have sympathy with them, as a result of they Respect that BitCoin’s glorious cash options.

On the identical time, he thinks that the advantages of maintaining USDT on electrical energy are clearly greater than that, as a result of many individuals nonetheless don’t perceive what BitCoin is, nor do they fluctuate it. Are completely happy on the abdomen.

He defined, “Many individuals haven’t but taken the orange capsule and so they have come to know the advantages of Bitcoin.”

“I feel BitCoin is an unimaginable instrument, and I need to convey it to an increasing number of individuals. On the identical time, conventional funds face many issues, and BitCoin has it very secure, There’s an auditable system, one thing I need to convey into the world on a scale.

“Though BitCoin value motion is nice for me, many individuals are afraid of fluctuations. In case you have a really low -fluctuating asset like USDT, now on very secure, dependable rails, this Is a large win.

The issue that’s solved on electrical energy

Shrader stated how the primary Bitcoin convention was hosted by a microscope was really known as “electrical energy for firms”. On the convention, firms have been inspired to start out paying workers in BitCoin in opposition to electrical energy – with none issues that may be as a result of time.

“The staff realized that the employers wanted to supply workers in 1099,” he stated. “And there was an entire regulatory overhead with which additionally they needed to compete.”

Shrader identified that not solely can workers within the USDT scale back accounting and regulatory complications within the mild of electrical energy, nevertheless it additionally reduces the chance of some counterparts related to using banks.

“Our payroll was passing by means of the Silicon Valley Financial institution,” stated Sharder.

“And, at one level, the Paul Supplier contacted me that I contacted me to ship my mid -month wage after making an attempt to pay the workers. I misplaced the runway for half a month. All this was as a result of the Silicon Valley Financial institution had modified.

“So, if I may keep away from the chance of counterparts within the monetary system by shifting in the direction of Bitcoin and electrical energy, meaning I am in a a lot better place.”

–

Dangers

Shrader famous a few of the risks of Bitcoin and electrical energy associated to electrical energy, however didn’t appear to fret an excessive amount of about them.

“There are some MEV dangers when you will have another belongings apart from the Blockchain’s ancestral belongings,” stated Sharder. “However BitCoin already has commonalities that make different belongings, so this downside is already there.”

Once I was vulnerable to a bitcoin thorns, ensuing within the danger of being ineffective to one in all a chains of 1 chains, nor does it suppose that the specter of main financial nodes within the Bitcoin community It’s, just like the Queen Base, which resulted in I didn’t pose the chance of bitcoin thorns, nor did it really feel. Within the custody of Bitcoin for the US Spot Bit Coin ETF, BitCoin’s “Trainer Kor”, which can embrace different upgrades that may harm Bitcoin. Lengthy -term

“BitCoin’s consensus isn’t decided by BitCoin’s custody, so when necessary enterprise like Quinn base can assist varied adjustments or measures, it doesn’t assure that adjustments within the protocol Will have an effect. “

As an alternative of specializing in the risks related to USDT on Bitcoin, the Shrader is doing the alternative.

“What’s extra fascinating is that there are in all probability alternatives you will have the power to mediate on BitCoin,” stated Sharder.

He added, “Since every node is able to transarating in each USDT and Bitcoin and is able to exchangeing a regionally mild electrical energy between them, you will have a electrical energy to BitCoin. Can ship out the channel and obtain USDT in another electrical channel of your electrical energy. “

“It may be as straightforward as producing USDT bill and paying it with BTC, balancing instant holding.”

2025: 12 months of electrical energy

In my interview with this, Sharder’s final views, he shared two of a very powerful causes as it is going to be 2025 years of electrical energy.

First, the conduct of BitCoin is not wanted to make use of electrical energy.

“By this yr, if individuals or companies need to go to electrical energy, they want Bitcoin first – and it is a main impediment,” she stated. (Sherader added in response to a comply with -up query, saying that outdoors the US, entry to USDT is comparatively straightforward and customary.)

“Solely bitcoin market is simply too small for cost processing. However this yr we now have eliminated this barrier, and shoppers will pay with one other asset – USDT. The market exists.

(Sherader additionally famous that when USDT is working on energy rails, BitCoin nonetheless advantages, as USDT is transformed to Bitcoin as a result of it crosses electrical energy . He added that “to function the electrical node, all of it makes the bitcoin extra useful to run the ability node.”)

As well as, the Sherader famous that the ability customers would pay solely a small portion of the transaction payment utilizing conventional monetary rails.

“We’re offering lower than 0.5 p.c of the liquidity,” stated Shrader.

He added, “Because the consumer of huge cost card networks, I’m paying 4 % for all these cost processing, and after cost, the quantity doesn’t seem from day to weeks.”

“With electrical energy, your cost processing payment falls to about 10x.”

Given the information of the Shereder, it’s troublesome to think about that there will likely be no massive yr for 2025 electrical energy.